Have you ever ran into a situation where you had an emergency or wanted to go on that weekend getaway, but the lacked the funds? Unfortunately, most of us, if not everyone has run into this issue a one point or another. The objective of this post is to get you on track to avoid this headache in the future. Your financial goals can be reached be doing the 5 simple things below:

- Create a Monthly Budget

- Pay Yourself First

- Start Investing in a 401(k)

- 30-Day Savings Challenge

- Apps To Help You Invest NOW (Bonus)

The simplest way of accomplishing this is to make a monthly budget. How finance 101 of me, right? Create a bare bones budget to allow room for greater saving and investment funds. I highly recommend using Mint’s Monthly Budget tool, another fine product from the people at Intuit! Not only can you set your monthly budget with Mint, they will also keep track of your spending. Sending out alerts when you have overspent or even are under set budgeted limits, how handy! For those individuals who have masterfully executed the monthly budget, you should start investing. Personal Capital wealth management software can take your investments to new heights. Oh, did I mention both of these amazing products are entirely FREE?

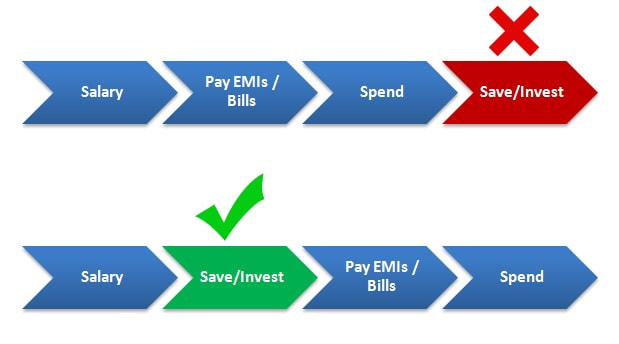

Don’t forget that you have to invest in yourself financially. Before you pay bills, buy groceries, or put gas in the car, pay yourself first! This isn’t always the easiest thing to do because we inadvertently make it difficult. Something that has helped me significantly was a suggestion made by my personal banker, who just so happens to have been the VP of Finance at Chase, advised me to transfer a designated amount per pay period into my savings account. Because the funds are automatically placed there I rarely even recognize it’s even missing. There is absolutely nothing wrong with taking a peak to see how much the account has grown. Just don’t touch it! Start small with $20-50 or a realistic percentage from each check that will go into your “rainy day fund.”

Now that you have a clear understanding of your income and expenses we can move forward. If you haven’t already researched what types of retirement plans your employer offers speak with your HR department. Most employers have a 401k plan that they will even match what you invest, up to a certain percentage. For example, my company GoDaddy automatically enrolls each employee deducting 3% per pay period, while matching this invest. I personally invest 6% of my income giving me a grand total of 12%, which is not too shabby. Let us evaluate this in dollars and cents. If my annual income is $50,000 that means $6,000 will go into my 401k every year. This amount does not include any raises or interest, meaning the previously mentioned amount is just the tip of the iceberg. Nerd Wallet has a simple to use 401k calculator that shows just how secure your future will be.

Everyone is a millionaire. The decision on how you will spend, waste, save, or invest your money is entirely up to you.

The Real Optimist

30 Day Savings Challenge

I am challenging each one of you to a 30 Day Savings Challenge. Over the next 30 days take $5-$10 each day moving it from your checking to savings account. For those individuals who would be tempted to touch it, open up a separate account that you will not have a debit card attached to it. By the end of this 30 Day Challenge you should invest this money using an app, such as, Acorns or Stash. These apps were created to help people to start investing with the smallest amount of money.

Compared to large banks and financial institutions who only will work with individuals with minimum sums of $50,000 or more to start. I have used Acorns for years and have seen my money grow exponentially.

Other Recommended Challenges:

10 Week Saving Sprint – by TCF Bank

52 Week Challenge – by Forbes

8 Savings Challenges – by DoughRoller.net